nd sales tax exemption form

Purchasers are responsible for knowing if they qualify to claim exemption from tax in the state that would otherwise be due tax on this sale. The Redemption of Waiver window is between March 2 nd and September 30 th of the current tax year.

Sample Letter Requesting Sales Tax Exemption Certificate Regarding Resale Certificate Cover Letter For Resume Teacher Resume Examples Resume Objective Examples

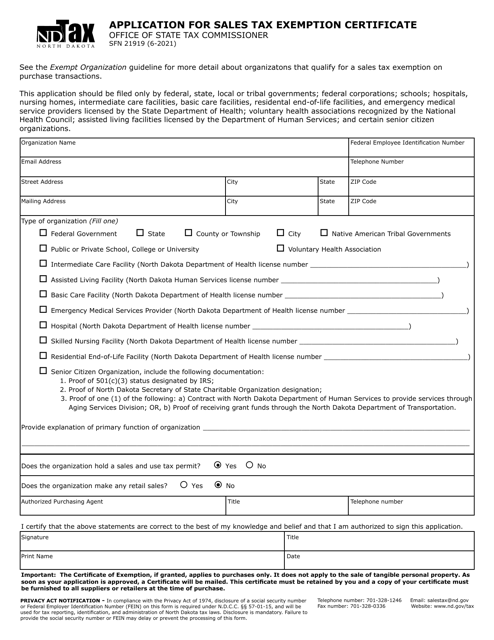

Tax permit number issued to you or your business by the North Dakota Office of State Tax Commissioner.

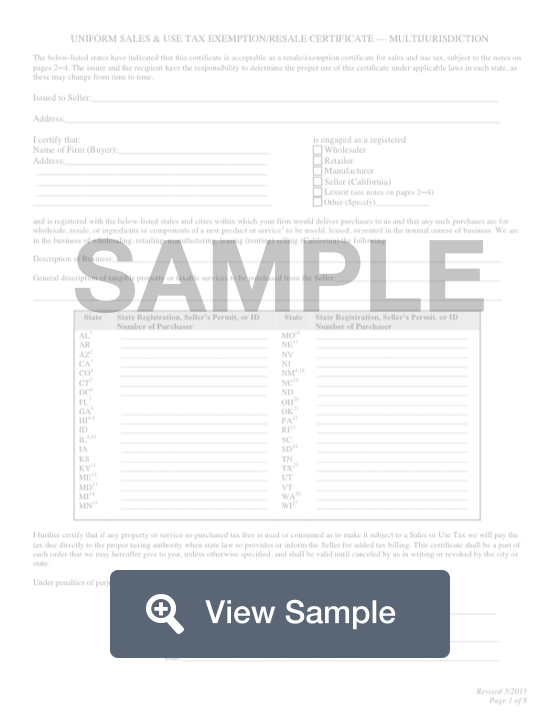

. Not all states allow all exemptions listed on this form. The seller may be required to provide this exemption certificate or the data elements required on the form to a state. Annual Resale Certificate for Sales Tax Form DR-13 to the seller.

North Dakota sales tax is comprised of 2 parts. The capital city of North Dakota States is Bismark. Regarding the specific exemption claimed and will remove the boat from Florida.

42 nd Street 18 th Fl. A nonresident dealer may purchase a boat for resale tax-exempt if the dealer. State Sales Tax The North Dakota sales tax rate is 5 for most retail sales.

North Dakota imposes a sales tax on retail sales. In individual states or performing proper due diligence to determine whether or not the organization qualifies for exemption in the states that accept this form. Gross receipts tax is applied to sales of.

North Dakota was admitted to the Union on November 2 1889 with is bordered state to the south South Dakota as the 39th and 40th states in the United States of America. It has the tallest man-made structure in Western Hemisphere which is. This includes boats used for bare boat charter.

The sales tax is paid by the purchaser and collected by the seller. For purchases made by a North Dakota exempt entity the purchasers tax identification number will be the North Dakota Sales Tax Exemption Number E-0000 issued to them by the North Dakota Office of State Tax Commissioner. 3 A boat of less than 5 net tons of admeasurement must leave Florida.

This is a multi-state form. All organizations may file a Tax Exemption Claim Form with a Redemption of Waiver Form if the property was owned and operated by the non- profit between January 1 st and March 1 st of the current tax year. Varying state processes for obtaining sales tax exemption can make it challenging to determine where.

North Dakota state is primarily rural with few cities.

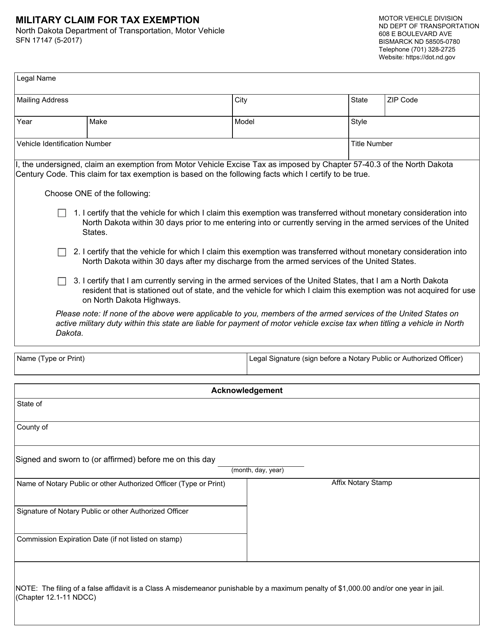

Form Sfn17147 Download Fillable Pdf Or Fill Online Military Claim For Tax Exemption North Dakota Templateroller

Free Form 21919 Application For Sales Tax Exemption Certificate Free Legal Forms Laws Com

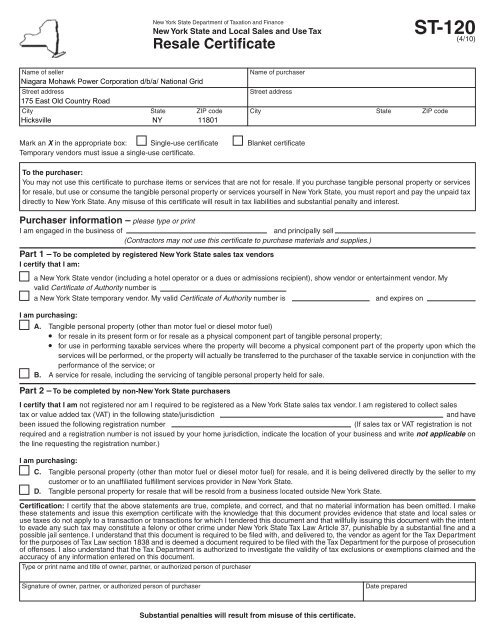

New York Sales Tax Exemption Form National Grid

South Dakota Tax Exempt Form Pdf Fill Online Printable Fillable Blank Pdffiller

Wi Sales Tax Exempt Form Fill Out And Sign Printable Pdf Template Signnow

Printable Illinois Sales Tax Exemption Certificates

Tax Exemption Form Free Tax Exempt Certificate Template Formswift

Form 21919 Application For Sales Tax Exemption Certificate

Form Sfn21919 Download Fillable Pdf Or Fill Online Application For Sales Tax Exemption Certificate North Dakota Templateroller

Application For Hospital Sales Tax Exemption Tax Exemption Illinois Sales Tax

How To Get A Sales Tax Exemption Certificate In Indiana Startingyourbusiness Com

Sample Letter Requesting Sales Tax Exemption Certificate Regarding Resale Certificate Cover Letter For Resume Teacher Resume Examples Resume Objective Examples

Minnesota Revenue Form St3 For Tax Exempt Orders

How To Get A Sales Tax Exemption Certificate In Colorado Startingyourbusiness Com

E 595e Web Fill 12 09 Fill Online Printable Fillable Blank Pdffiller

Form 21999 Fillable Streamlined Sales And Use Tax Agreement Certificate Of Exemption

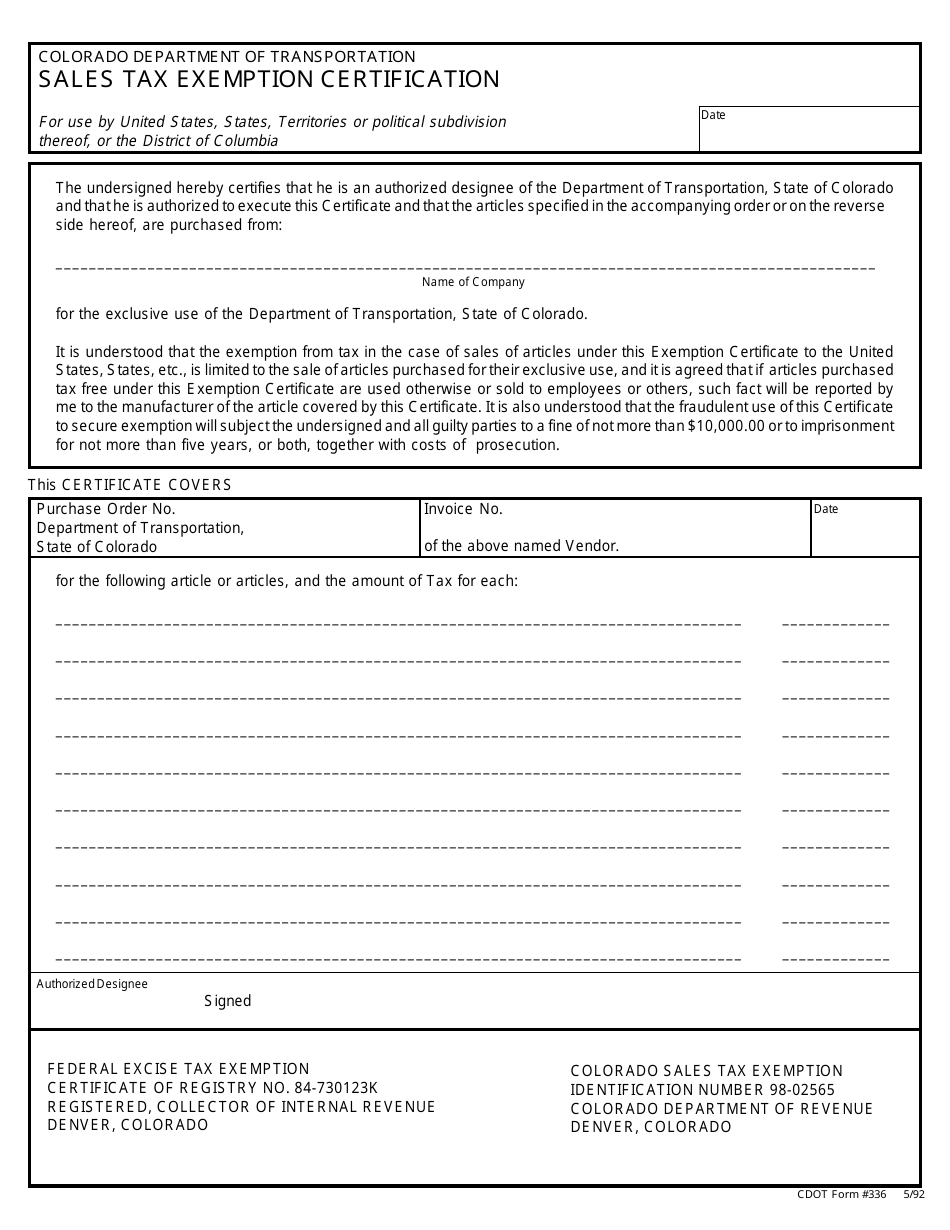

Cdot Form 336 Download Printable Pdf Or Fill Online Sales Tax Exemption Certification Colorado Templateroller

How To Get A Sales Tax Exemption Certificate In Missouri Startingyourbusiness Com

Costco Sales Tax Exempt Form Fill Online Printable Fillable Blank Pdffiller